Bicycle-sharing (or Bike-sharing) is a service where bicycles are made available for shared use to individuals on a short-term basis. In Singapore, the Bike-sharing scene is dominated by dockless bicycles offered by several private companies, independent of Government funding. This is in contrast to docked systems in other cities where bicycles can only be borrowed and returned from designated docking stations.

Bicycle-sharing operators entered the Singapore scene in January 2017 when local company oBike rolled out its bicycles to the public. ofo and Mobike soon followed later that year, and the three companies have dominated the market ever since. Smaller operators have also entered the local scene in an attempt to carve out a niche for themselves.

Bike-sharing is an attractive first-mile, last-mile commute option for many, complementing existing public transport options in Singapore such as buses and trains. As such, shared bikes can often be found near bus stops and MRT stations. The Government also responded by introducing new bicycle parking zones around the island, demarcated by yellow lines.

While initially supportive of these efforts amid a push for Singapore to be a car-lite city, the Government was also subject to public criticism by being slow to enact regulations governing the bike-sharing scene, leading to oversupply and indiscriminate parking plaguing many areas around Singapore.

History

In 2016, The Land Transport Authority (LTA) originally intended to launch a bike-sharing system. To improve first-and-last-mile connectivity and encourage cycling for short trips, LTA had called a tender in July 2016 for an operator to build, own, operate and maintain a bicycle-sharing system in Jurong Lake District. To defray part of the costs, tenderers could bid for grants from LTA. The experiences of docked bicycle-sharing programmes in cities such as London and Taipei have been that they typically require public sector funding for sustainability.

The tender closed in December 2016 and attracted a total of 13 bids from local and foreign participants. The proposals were a mix of both docked and dockless bicycle-sharing systems. However, following the emergence of fully privately-funded dockless bicycle-sharing services in early 2017, the Government tender was not awarded.

In the meantime, Singapore-based company oBike rolled out its bicycles to the public in January 2017 with its silver-yellow bikes around the island. In addition to a fee charged per-ride (50 cents for 15 minutes), the operator also collected a refundable deposit of $50 from users. They were soon joined by ofo and Mobike, which were established players in the bike-sharing market with a huge presence in China. Their bikes were yellow and orange-silver respectively.

While all three operators initially charged a deposit, ofo quickly gained popularity by dropping the deposit and offering perpetually free rides (by repeatedly extending its free-ride promotional period) until early 2018. Mobike followed suit, dropping its deposit but continued to charge on a per-ride basis. oBike, ofo and Mobike expanded rapidly, introducing thousands of bicycles across the island and emerging as the dominant players in the industry.

In November 2017, Mobike introduced the first duration passes. Available from anywhere between a week to several months, passes allowed riders unlimited use of bikes throughout the period of validity without the need to pay a deposit. When initially sold at low promotional prices, these passes were very well-received and ofo soon followed suit. oBike, on the other hand, stuck with its deposit-before-use and charging per-ride model, eroding its market share until it too introduced a deposit-free duration pass in mid-2018.

While oBike, ofo and Mobike dominated the market, a number of smaller players emerged on the bike-sharing scene in an attempt to gain a share of a market and to carve out a niche for themselves, such as GBikes, SG Bike, ShareBike SG and Anywheel. In particular, SG Bike accepts payment by EZ-Link card, and ShareBike SG offers lightweight mountain bikes with multiple gears.

Exit Plans

In 2018, a saturated market and a new licensing regime marked led to several bike-sharing companies exiting the market. Most significantly, major player oBike ceased operations abruptly on 25 June as the company went into liquidation. ShareBike SG ceased offering its bikes in June 2018, and GBikes ceased operations on 7 July 2018, the same day the new licensing regime kicked in.

oBike cited difficulties in complying with proposed regulations as the reason for its folding. However, it was widely understood that the company itself was facing increasing financial pressures throughout the duration of their Singapore operations. The abrupt exit left many users with unrefunded deposits of $19 or $49, which amounted to about S6.3 million. In addition, it owed more than $140,000 in fines to at least five town councils as a result of indiscriminate parking. Work to remove the bicycles began on 2 July, as several companies were appointed to clear the bikes from public areas.

The exit of oBike from the local bike-sharing scene brought about much greater public scrutiny into the operations of shared bike companies, and in particular, the accountability to users when businesses go south. Some criticism was also raised at government agencies for the lack of regulation enforce on the rapidly expanding bike-sharing industry; however, the failure of oBike was widely seen as simply a failure of a private venture. In response to users’ uncertainty over oBike deposits, Mobike offered refunds to existing users who had previously paid a deposit for their services.

ofo‘s Dockless Bicycle-Sharing Operator License was suspended on 14 February 2019 after failing to comply to regulatory requirements of the license.

On 11 March 2019, Mobike made an application to seek consent to surrender its bicycle-sharing license in Singapore.

Public Response

While members of the public have welcomed the dockless bicycles, they were also a source of public complaints, with indiscriminate parking being the main gripe. Bicycles were often obstructing common areas and becoming an eyesore when strewn in public places. This was particularly common around MRT stations and construction sites where there are many shared bike users. Competition between companies exacerbated this problem as they grew their fleets too quickly in a bid to capture market share; there were over 100,000 shared bikes in Singapore in just over a year after introduction.

Bicycles were sometimes vandalized: they would have their locks broken/dismantled, or had their seats removed. Bicycles also turned up in canals, and in June 2017, there were two occasions of bikes being tossed from Housing Board blocks.

Bike maintenance was also an issue. Although operators are required to remove faulty bikes within a day, some bikes were not removed after several weeks or months.

Dockless Bicycle-Sharing Operator License

Following the passing of the Parking Places (Amendment) Bill in March 2018, bicycle-sharing operators were made to apply for a licence to curb the problem of indiscriminate parking. Under the licensing regime, operators who have a licence will be allowed to operate in public spaces for up to two years.

There are three key aspects to the licensing framework:

Regulated maximum fleet size

The LTA will impose conditions on the maximum fleet size that each operator can deploy. Given the scale of the indiscriminate parking problem today, LTA will take a more conservative approach in setting the fleet sizes. However, operators who are able to manage indiscriminate parking and ensure good bicycle utilisation will be allowed to grow their fleets over time.

Twice a year, in January and July, licensed bike-sharing operators may submit applications for fleet size expansion to LTA. Licensees that are able to minimising indiscriminate parking and maximising utilisation rate will have the opportunity to have an increased fleet size.

License conditions & industry standards

Operators will be subjected to licence conditions and industry-wide standards imposed by LTA. LTA will take regulatory action against operators for breaches of licence conditions and standards, which includes reducing their fleet size, imposing financial penalties of up to $100,000 for each instance of non-compliance, suspension, or revocation of licence.

Unlicensed bike-sharing operators can face a fine of up to $10,000 and/or a jail term of up to six months, with a further fine of $500 for each day the offence continues after conviction.

Parking enforcement

Operators will have to take measures to ensure that their users practice responsible parking.

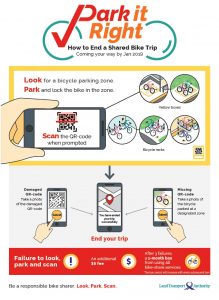

This includes requiring their users to scan the unique QR code at the parking location as proof of proper parking before they can end their trip, and charging users who park indiscriminately a fee of $5.

Operators will be required to share data with each other on users who park indiscriminately for the purpose of imposing a collective ban on recalcitrant users.

An individual user who has been determined to have parked indiscriminately at least 3 times in a calendar year when renting from one or more operators will be banned for one month from using all bicycle-sharing services. The ban period will increase up to one year for recalcitrant users who continue to park indiscriminately.

In addition, all licensees must share data to LTA on the locations of all their stationary bicycles to enable real-time monitoring of the bicycles’ locations and better management of indiscriminate parking.

LTA also requires sharing of anonymous trip route data to facilitate the planning of active mobility infrastructure.

Types of Licenses & License Assessment Criteria

Bike-sharing operators may choose to apply for a Full License or a Sandbox License.

A sandbox license may be granted to operators with little or no experience in operating shared bicycles in Singapore to encourage innovation and reduce barriers to entry for new operators. Operators granted a sandbox license may operate a maximum fleet size of up to 1,000 and are subject to a subset of the full licence requirements. The sandbox license also helps new operators to learn how to manage their fleet responsibly before scaling up. LTA will monitor the sandbox licensees’ performance closely before determining whether to grant them full licences.

LTA assesses each Dockless Bicycle-Sharing Operator license application based on a set of criteria, including the following:

- Ability to manage indiscriminate parking

- Fleet utilisation rate

- Financial strength (for Full License only)

- Redistribution plans

- Overall demand for shared-bicycles

- Availability of parking spaces

- Track record of managing cases of indiscriminate parking (where applicable)

Licensed Dockless Bicycle-Sharing Operators

As of April 2019

| Operator | License | Livery | Approved Fleet Size |

| Mobike | Full | Silver & Orange | 25,000 |

| Anywheel | Full | Green | 10,000 |

| SG Bike | Full | Red & White | 3,000 |

| Moov | Sandbox | Yellow | 1,000 |

| Grabcycle | Sandbox | Various | 1,000 |

| Qiqi ZhiXiang | Sandbox | TBA | 500 |

Notes

- GBikes’ license application was not successful.

Former Bike-Sharing Operators

| Operator | Livery | Period | Remarks |

| oBike | Silver & Yellow | Jan 2017 – Jun 2018 | Ceased Operations |

| GBikes | Yellow | May 2017 – Jun 2018 | Ceased Operations Unsuccessful License Application |

| ShareBike SG | Red | Dec 2017 – Jun 2018 | Ceased Operations |

| ofo | Yellow | 2017 – Feb 2019 | Ceased Operations License Suspended |

| BaiCycle | Grey | – | Not Launched |

| Airbike | Blue | – | Not Launched |

Note:

Bikes from Baicycle (white) and Airbike (blue) have been spotted, but these operators have yet to be officially launched.

External Links & References:

- Non-Award of Bicycle-Sharing Tender – LTA

- LTA rolls out bicycle parking zones – Channel NewsAsia

- Bike-sharing in Singapore gathers speed after 1 year, but there may be bumps ahead – Straits Times

- LTA to Commence Licence Applications for Bicycle-Sharing Operators

- LTA Makes Bicycle Parking Neater and more Accessible – LTA

- Six Applications for Dockless Bicycle-Sharing Operating Licenses Receive In-principle Approval from LTA – LTA

- LTA awards licences to six bike-sharing operators; ofo to downsize fleet to 10,000 – ChannelNewsAsia

- Mobike calls it quits, seeks LTA approval to surrender licence – ChannelNewsAsia

- LTA suspends Ofo’s operating licence, bikes to be removed from public spaces – ChannelNewsAsia

- Two Applications for Dockless Bicycle-Sharing Operator Licences Receive In-Principle Approval from LTA – LTA

Hi there! Is there any update on Baicycle? I found an article from the July of 2018, which states “Baicycle may or may not be in operation after 7 July”. I couldn’t really find further info on this, so I assume they failed to launch. Or are they still trying to get licenses?